What if you could place your own private currrency and use it?

Experiment of economic theory in real life.

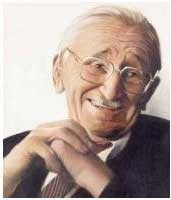

Friedrich Von Hayek, winner of the Nobel Prize in Economics in 1974, pointed out that the monopoly of the States to issue currency translates into damages for the people.

According to his theory, the centralized committees that manage the currencies do not have all the necessary information and will end up, despite their good intentions, making wrong decisions.In a book nearly forgotten so far, 'The Denationalization of Money' he proposes that private entities can place their respective currencies and these compete against each other as any product.

In the absence of this monopoly of the state, the parties to a contract could agree monetary assets that they consider preferable to safeguard their interests.

His idea received harsh criticism both from the defenders of state intervention (with Keynes as one of its main critics) and from the liberals (Milton Friedman found serious deficiencies in the idea). His thought was always very politicized and provoked numerous controversies.

His idea received harsh criticism both from the defenders of state intervention (with Keynes as one of its main critics) and from the liberals (Milton Friedman found serious deficiencies in the idea). His thought was always very politicized and provoked numerous controversies.

Subsequently, Hayek realized that so many different currencies would make up a messy system and speculated that markets would converge on a limited number of them and published it in an updated version of his book with the subtitle "The Refined Argument."

|

| Photo by Thought Catalog on Unsplash |

Nowadays, with the irruption of cryptocurrencies (more than 100 virtual coins minted outside the government and many already with some influence in the economy as Bitcoin and Ethereum), we will experience that theoretical assumption of the 70s of the last century.

What possibilities and threats will this new reality bring? Surely everything will go much further than Hayek, his followers and his detractors came to imagine.

|

| Photo by Andre Francois on Unsplash |

And about the competition between different currencies in this link published on trustnodes.com, the question arises of the adjustment experienced by the different cryptocurrencies in the face of different contingencies: software errors, competition, evolution of trust ... the theory put into practice.

To give a broad view, we add the reference to this link where Paul Butler rejects the frequent association that Hayek is making as the prophetic economist of cryptocurrencies. The author details the differences of what was raised by Hayek and the current panorama.

Comentarios

Publicar un comentario